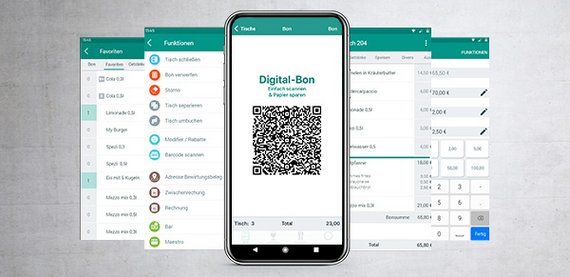

myVectron Digital receipt

The alternative to the paper receipt

The myVectron digital receipt helps you save costs and paper. Customers can scan a QR code on the customer display with their mobile phone. This QR code leads to the digital invoice, which can be saved on the end device. Alternatively, a paper receipt can be printed as before, if desired.

Advantages of the digital receipt at a glance:

- As the legally-compliant alternative to the paper receipt the digital receipt saves paper and protects the environment.

- Users of the myVectron Standard digital package can integrate the digital receipt without extra costs.

- End users do not have to register or download an app in order to use the receipt.

The prerequisite for using the digital receipt is

- a Vectron POS version as of 6.3.16.0

- a Vectron Digital package and

- a customer display (C11 or C100). The MobileApp can be used as an alternative to the customer display.

The myVectron Digital receipt is legally compliant

Can you use the myVectron digital receipt to comply with the receipt issuance obligation according to the German Cash Register Security Ordinance 2020? Yes, this is possible.

Digital receipt on the MobileApp

You can also issue the digital receipts via the Vectron MobileApp. For waiters this means less walking and more time.

This module is included in the myVectron Standard package in several countries and can be booked additionally in combination with the myVectron Start package in several countries. Please check with your retailer.

Interested? Contact us now.

Tel.: +49 251 2856150

(Mon - Fri, 9 a.m. to 5 p.m. CET)

Looking for advice directly on site? No problem. Contact our competent specialist dealers in your area.

Disclaimer

All data and information related to the legal requirements for POS systems in Germany represent only a current assessment of Vectron Systems AG. Vectron Systems AG does not assume liability for correctness and completeness of this assessment. All data and information do neither constitute legal advice nor tax advice. For binding clarification of corresponding legal and/or tax questions, please contact your lawyer or tax advisor.